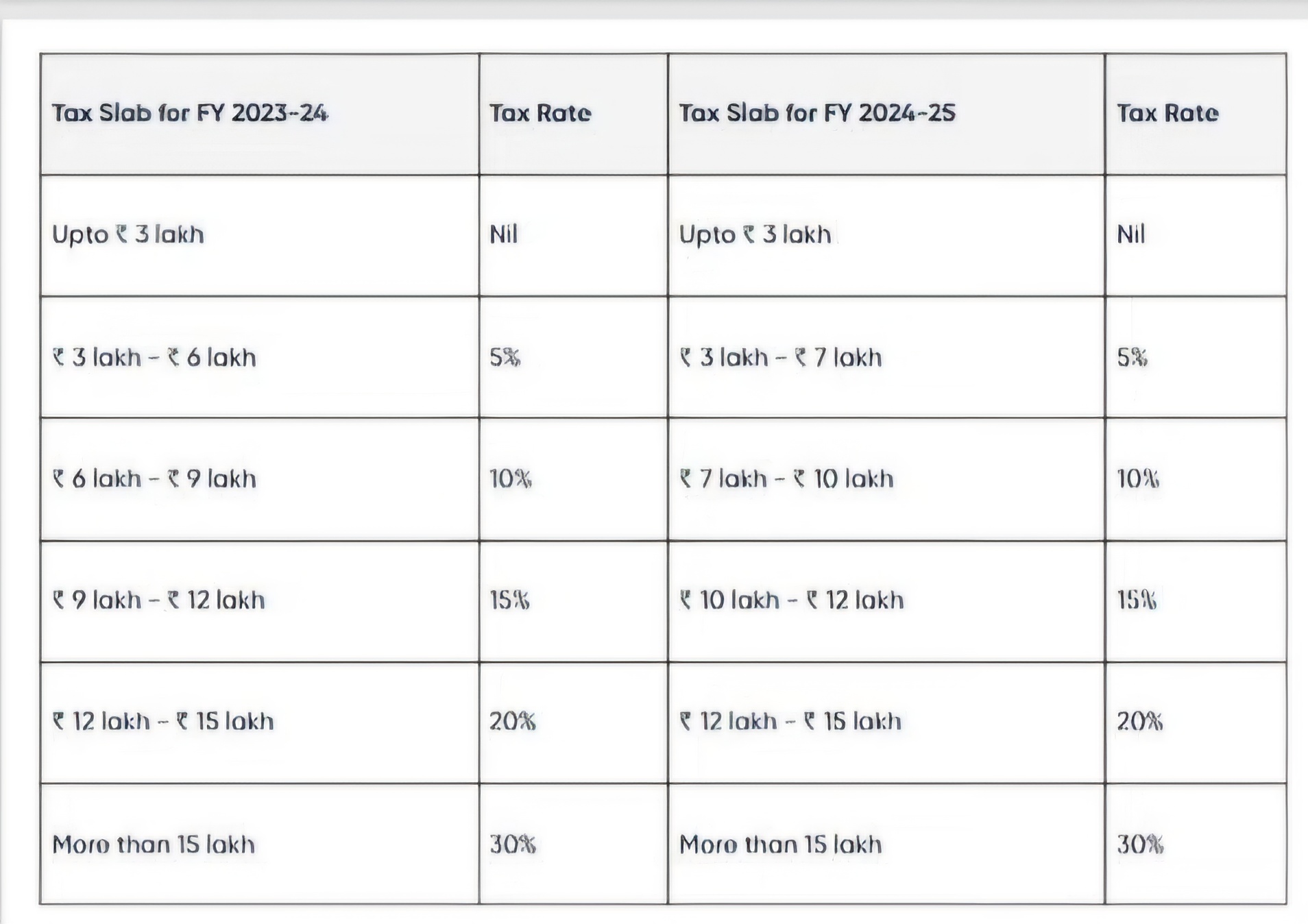

_Union Budget 2024_

*STANDARD DEDUCTION*

Standard deduction for Salaried employees to be increased from Rs 50,000 to Rs 75,000 under new tax regime

In addition, deduction on family pension for pensioners will be increased from ₹15,000 to ₹ 25,000.

*Capital Gain Tax*

• Short term gains of financial assets to attract 20% tax rate earlier 15%. Long term gains on all financial and non-financial of capital gains assets to attract a tax rate of 12.50% earlier 10%. • Increase in limit of exemption of capital gains(LTCG) on finarcial assets to ₹1.25 lakh per year.

*Tax on Derivative Trades*

It is proposed to increase the rates of STT on sale of a futures in securities from 0.0125 per cent to 0.02 per cent of the price at which such futures are traded. and on, sale of an option in securities from 0.0625 per cent to 0.1 per cent of the option premium

*Long term Gain Tax*

Listed financial assets held for more than a year will be classified as long term, while unlisted financial assets and all non-financial assets (eg property) will have to be held for at least two years to be classified as long-term.

*Tax on buy back*

Budget 2024 proposed that the income from buy-back of shares by companies be chargeable in the hands of the recipient investor as dividend, instead of the current regime of additional income-tax in the hands of the company. (applicable from 1st October 2024)

*Penalty on Foreign Share*

Budget 2024 has announced relief for Indian employees working with multinational companies and deputed abroad for assignments.

They get ESOPs from such companies and often have to open bank accounts and enroll into social security schemes abroad Under the current rules, an inaccurate disclosure or failure to report such foreign assets in income tax returns can result in penalty of up to Rs 10 lakh Now, non-reporting of such financial assets valued at up to Rs 20 lakh not invite any penalty.

Recent Posts

Popular Tag

banks

budget

business insurance

credit card

culture

financial planning

health insurance

incredible india

indian railway

indian tourism

india tourism

india travel

insurance

invest

investment

loan

Lotus temple

mutual fund

personal finance

personal investment

real estate

Science

Spiritual

startup

tax

travel

travel blogger

travel tip

Subscribe for Daily Newsletter